How to Find a Registered Tax Agent in Australia for Your Annual Tax Filing

How to Find a Registered Tax Agent in Australia for Your Annual Tax Filing

Blog Article

Understanding the Significance of an Income Tax Return: Exactly How It Influences Your Monetary Future

Recognizing the relevance of a Tax return prolongs beyond plain compliance; it serves as a pivotal device in shaping your economic trajectory. A thorough tax obligation return can influence essential choices, such as finance eligibility and possible cost savings via credit scores and reductions. Lots of people ignore the effects of their tax filings, usually neglecting the wealth-building possibilities they provide.

Review of Income Tax Return

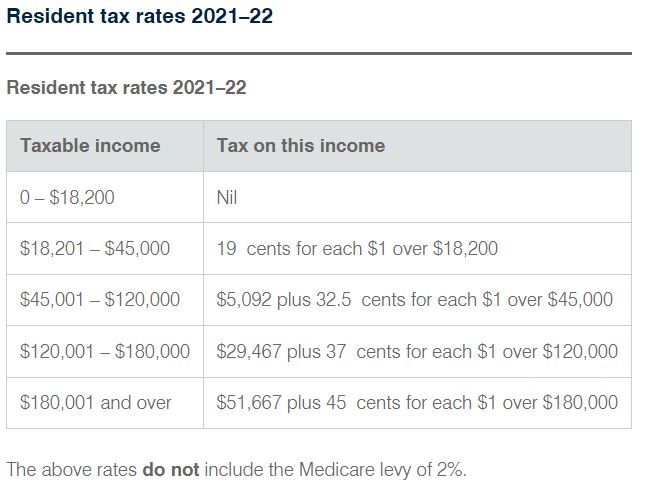

Tax obligation returns are vital files that services and individuals submit with tax obligation authorities to report earnings, expenditures, and other monetary details for a specific tax year. These comprehensive types serve numerous functions, consisting of determining tax liabilities, declaring deductions, and examining eligibility for different tax obligation credit histories. The key parts of an income tax return commonly consist of earnings from all resources, modifications to income, and an in-depth failure of deductions and credit reports that can decrease overall taxable earnings.

For individuals, common forms consist of the IRS Form 1040 in the United States, which lays out earnings, passion, returns, and various other forms of revenue. Businesses, on the other hand, may utilize the internal revenue service Form 1120 or 1065, depending on their structure, to report corporate revenue and expenses.

Filing income tax return accurately and timely is important, as it not only ensures conformity with tax obligation laws but likewise influences future economic planning. A well-prepared income tax return can provide insights into monetary wellness, emphasize locations for prospective cost savings, and promote informed decision-making for both companies and individuals. The complexities involved require a thorough understanding of the tax code, making expert advice usually advantageous.

Effect on Funding Qualification

Precise and timely entry of income tax return plays a vital role in determining an individual's or company's qualification for car loans. Lenders frequently require recent tax obligation returns as part of their assessment procedure, as they supply an extensive review of income, economic security, and total economic health. This documents assists lenders gauge the debtor's capability to pay off the loan.

For individuals, constant income reported on tax returns can boost creditworthiness, leading to a lot more favorable finance terms. Lenders usually look for a steady income background, as changing incomes can increase issues concerning payment capacity. In a similar way, for services, income tax return act as a substantial indicator of success and capital, which are important consider protecting organization financings.

Furthermore, inconsistencies or mistakes in income tax return may elevate warnings for loan providers, possibly leading to lending denial. Therefore, keeping accurate documents and declaring returns promptly is vital for services and individuals aiming to enhance their car loan eligibility. In conclusion, a well-prepared income tax return is not just a lawful demand however additionally a tactical tool in leveraging monetary possibilities, making it essential for any person thinking about a finance.

Tax Obligation Debts and Reductions

Comprehending the subtleties of tax credit scores and reductions is essential for enhancing economic end results. Tax obligation credit scores straight decrease the amount of tax owed, while deductions lower taxable revenue. This difference is substantial; for example, a $1,000 tax credit lowers your tax obligation expense by $1,000, whereas a $1,000 deduction decreases your taxable income by that quantity, which results in a smaller tax decrease depending upon your tax obligation bracket.

Reductions, on the other hand, can be itemized or taken as a typical deduction. Detailing enables taxpayers to listing eligible costs such as mortgage rate of interest and medical prices, whereas the standard reduction offers a fixed reduction amount based upon filing status.

Planning for Future Investments

Efficient planning for future financial investments is vital for building riches and achieving monetary goals. A well-structured financial investment approach can aid people take advantage of prospective development opportunities while additionally alleviating risks linked with market variations. Recognizing your tax obligation return is an essential component of this planning process, as it provides understanding right into your economic wellness and tax commitments.

Furthermore, knowing exactly how financial investments might affect your tax obligation circumstance enables you to pick financial investment automobiles that align with your overall monetary method. Prioritizing tax-efficient investments, such as lasting funding gains or municipal bonds, can improve your after-tax returns.

Common Tax Obligation Return Myths

Lots of people hold false impressions check my site about tax obligation returns that can result in confusion and expensive blunders. One widespread misconception is that submitting a Tax return is only necessary for those with a significant income. In truth, also people with reduced revenues might be called for to file, particularly if they get track my tax return approved for certain credit reports or have self-employment income.

One more typical myth is the belief that obtaining a refund suggests no taxes are owed. While reimbursements indicate overpayment, they do not absolve one from responsibility if taxes schedule - Online tax return. Additionally, some believe that income tax return are just important throughout tax obligation period; nonetheless, they play a vital duty in economic preparation throughout the year, impacting credit report and lending eligibility

Many additionally think that if they can not pay their tax costs, they ought to prevent declaring altogether. This can result in charges and rate of interest, intensifying the issue. Finally, some presume that tax obligation preparation software program warranties accuracy. While useful, it is essential for taxpayers to comprehend their unique tax obligation scenario and testimonial access to confirm compliance.

Eliminating these misconceptions is important for effective monetary monitoring and avoiding unneeded issues.

Conclusion

To sum up, tax returns offer as a basic component of monetary management, influencing car loan eligibility, uncovering possible financial savings through credits and reductions, and informing calculated financial investment choices. Overlooking the value of accurate tax return declaring can result in missed financial chances and prevent effective monetary preparation.

Tax returns are important documents that businesses and individuals file with tax obligation authorities to report revenue, costs, and other monetary info for a details tax obligation year.Filing tax returns properly and prompt is essential, as it not just ensures conformity with tax obligation laws however likewise influences future monetary planning. Nonrefundable credit scores can just reduce your tax obligation to no, while refundable credit scores might result in a Tax reimbursement surpassing your tax obligation owed. Common tax obligation credit ratings consist of the Earned Earnings Tax Debt and the Youngster Tax Credit history, both aimed at sustaining family members and people.

In addition, some think that tax returns are only crucial during tax obligation period; however, they play an important function in economic preparation throughout the year, influencing credit scores and financing qualification.

Report this page